Nike�(NYSE:NKE) has been telling investors for the past several quarters that it was building toward a rebound in its core U.S. market. You had to squint to see evidence of that shifting trend in its last few quarterly reports, but management's comments in late March made it clear that this long-anticipated recovery had just started.

As a result, Nike is expected to reveal solid sales and profitability numbers in its quarterly report on Thursday, June 28. Let's examine exactly what investors will be looking for in this announcement.

Image source: Getty Images.

Sales and profits in the U.S.Nike generates more than half of its sales from outside of the United States, but its home market is still important to overall revenue and profit trends. The segment has been pressured for close to two years as customers shifted their shopping habits online and forced retailers to use price cuts to work through a big inventory buildup.

The most recent results didn't show that sales trend reversing. In fact, revenue was down 6% in the U.S. last quarter, compared to a 5% drop in the prior quarter. However, Nike lessened its reliance on price cuts, which allowed gross profit margin to fall by just 0.7 percentage points. That result beat management's forecast and also marked a solid improvement over the prior quarter's 1.2-percentage-point drop.

The bigger news was management's shifting tone toward more optimism about the U.S market. Back in December executives said they were hoping the segment might begin to stabilize soon. By March, the comments were much brighter. "We now see a significant reversal of trend in North America," CEO Mark Parker said in late March.

As a result, investors are looking for the U.S. market to show roughly flat sales results in the context of improving gross profit margin trends on Thursday.

International gainsNike's bigger international footprint has helped protect its earnings from the type of collapse that rival Under Armour�has endured. The Chinese market in particular is important for investors to watch, since management has staked a large portion of its future growth on that division.

While the sports apparel industry niche in the U.S. is projected to hold steady at about 50 million people, China's should soar to 10 times that total over the next few years. That's a key reason why Nike believes it can expand sales there in the low to mid-teen percentage range between now and 2022. Parker is likely to spend plenty of time on Thursday talking about demand trends there, which recently showed healthy growth of almost 20%. �

The new fiscal yearExecutives suggested back in March that Nike's new fiscal year would bring broad improvements to the business. Sales growth is likely to return to positive territory in the U.S. in fiscal 2019, they said, and faster gains in international markets should also support what they called "strong" growth in profitability.

Nike didn't issue specific numbers to back up those general forecasts, and so investors have had to hold tight until the fiscal fourth-quarter announcement for their first look at the company's 2019 outlook. Positive earnings reports over the last few weeks, both from rivals and from retailing partners, have suggested that this prediction might include robust sales and profit growth. But now it's up to Nike to deliver on the optimism it has helped build on Wall Street over the past few months.

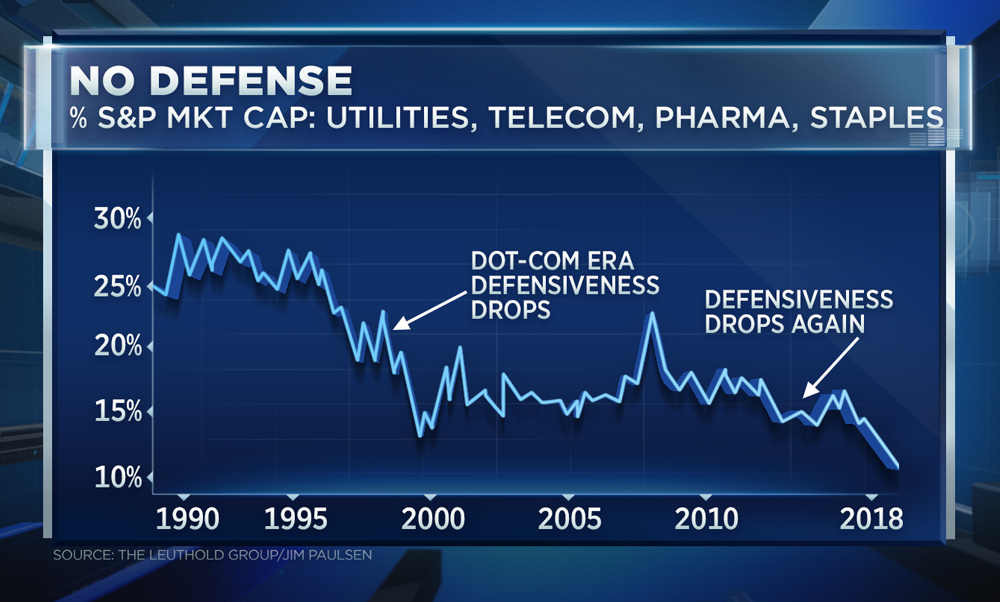

No defense: Investors are fleeing safety stocks at an alarming rate 16 Hours Ago | 05:51 Disclaimer

No defense: Investors are fleeing safety stocks at an alarming rate 16 Hours Ago | 05:51 Disclaimer